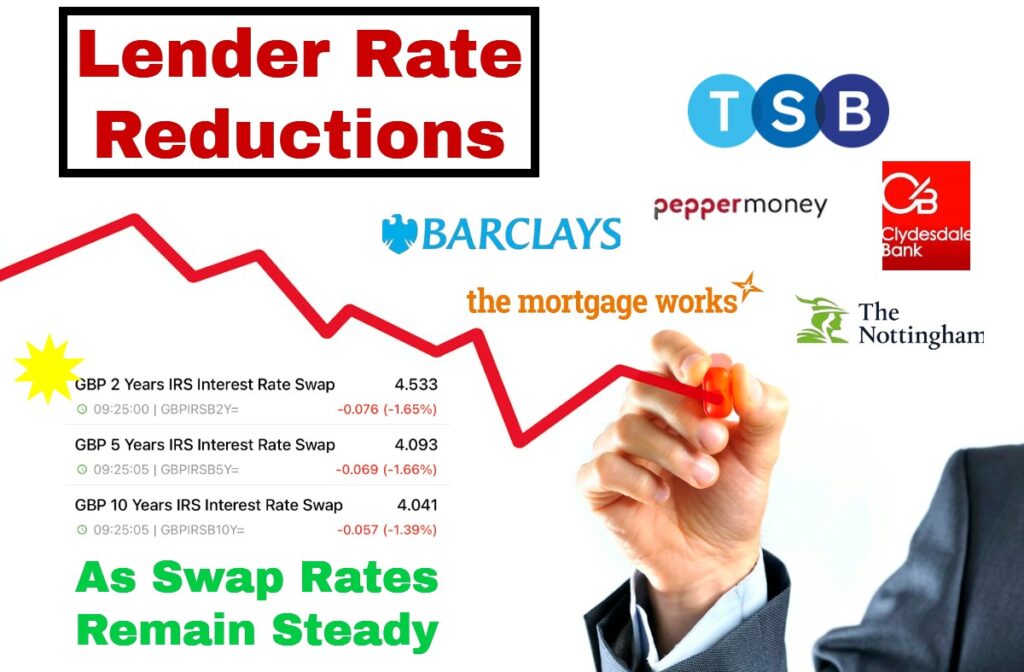

Lenders Drop Rates As Swap Rates Stabilise

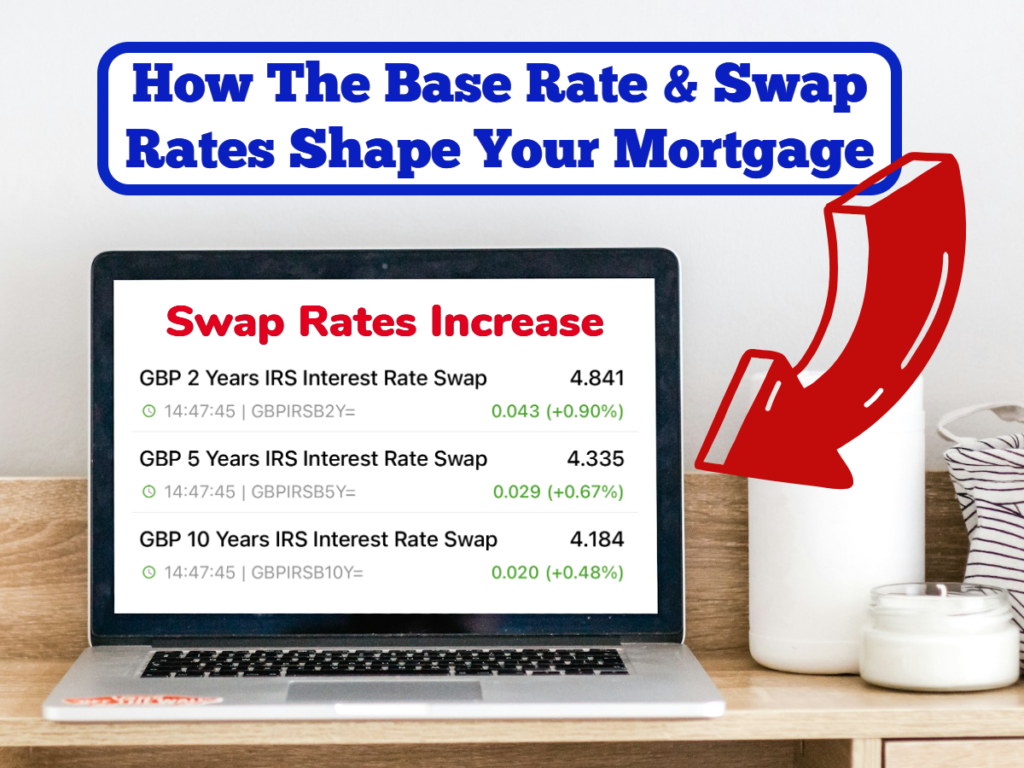

Mortgage Rates Reduced Following the election, the swift rise in swap rates led many lenders to increase their mortgage rates. This strategic move was designed to protect against potential future borrowing costs. However, as swap rates stabilised, lenders grew more confident in the market’s equilibrium. This newfound stability enabled them to reduce mortgage rates, benefiting […]

Lenders Drop Rates As Swap Rates Stabilise Read More »