Rate Cut In Doubt As Inflation Falls

It was announced this week that inflation fell from 3.2% to 2.3%, slightly above the market forecast of 2.1%. Though smaller than expected, the drop is still positive as it is now lower than the Eurozone and US inflation figures.

A rate cut in June now seems highly unlikely, and the possibility of an August cut is also in doubt. The Bank of England (BoE) had anticipated a larger decline in services inflation, but instead, inflation in hotels and restaurants increased from 5.8% to 6%, and in venues such as concerts and cinemas rose from 5.4% to 8.3%.

Attention now turns to the next set of labour market data due in June. Despite this setback, the outlook for the rest of 2024 remains optimistic. Inflation is expected to fall below the 2% target.

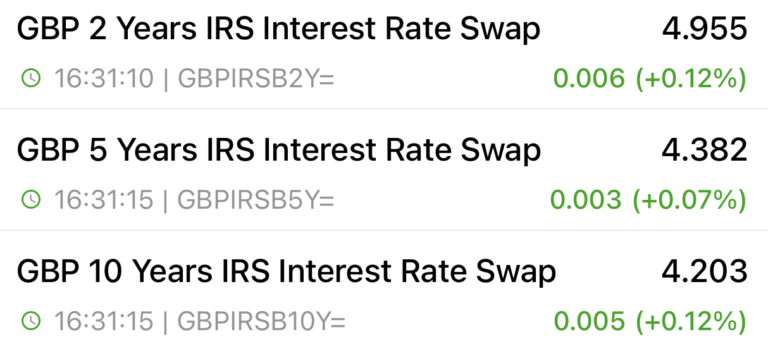

Swaps and market makers have already reacted to this news, impacting market strategies.

It’s important to remember the longer-term view is positive, with rate cuts anticipated from Q4 2024 and throughout 2025.

The Bigger Picture As 2 Year Swaps Edge Toward 5%

UK inflation recently dropped from 3.2% to 2.3%, a development that might initially seem optimistic for the economy. Lower inflation generally indicates stabilising living costs, which can ease the burden on households and businesses. However, the factors behind this decline are complex and varied. Despite the drop in inflation, swap rates, especially the 2-year swaps, are approaching 5%. Swap rates reflect market expectations of future interest rates and can diverge from current inflation trends for several reasons.

The Bigger Picture: While the immediate drop in inflation is encouraging, it’s crucial to understand that swap rates incorporate forward-looking expectations. The rise in 2-year swap rates towards 5% suggests that markets anticipate prolonged higher interest rates influenced by domestic and global economic factors.

24th May Swaps

9th May Swaps

Schedule A Mortgage Review

If you want to benefit from the latest rate reductions, call 0800 0350095 or click on the button below to schedule a review.