Lenders Increase Rates

This week, a wave of lenders increased their rates upward, driven by unexpected inflation figures. As consumer prices returned above initial forecasts, lenders faced heightened operational costs and increased risk exposure. To maintain profitability and safeguard against inflationary pressures, these lenders are compelled to adjust rates accordingly.

What Next For The Bank Of England

The Bank of England (BoE) Monetary policy Committee (MPC) will likely stand firm against cutting rates next week despite prolonged period of stability. The sole advocate for a rate reduction at February’s meeting signifies a cautious approach, likely to endure into the upcoming March 21 meeting. While the prospect of rate cuts remains on the agenda, emerging rhetoric preceding the meeting suggests a reluctance to implement cuts any time soon.

As anticipation builds towards the March meeting, market participants and economists closely scrutinise the evolving rhetoric from the Bank of England. While rate cuts are not entirely off the table, the prevailing sentiment suggests that any adjustments will be approached with careful consideration and a commitment to maintaining stability in the face of ongoing economic uncertainties.

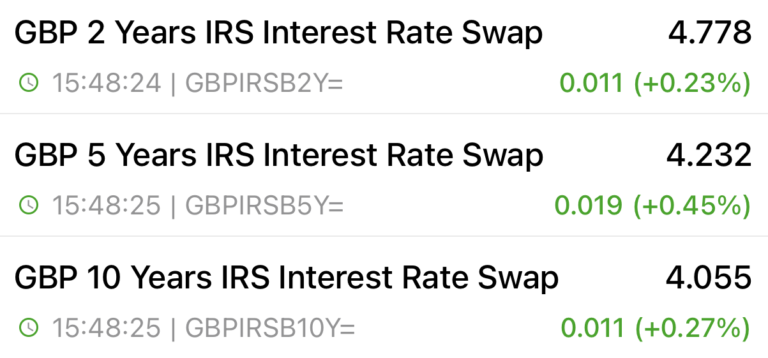

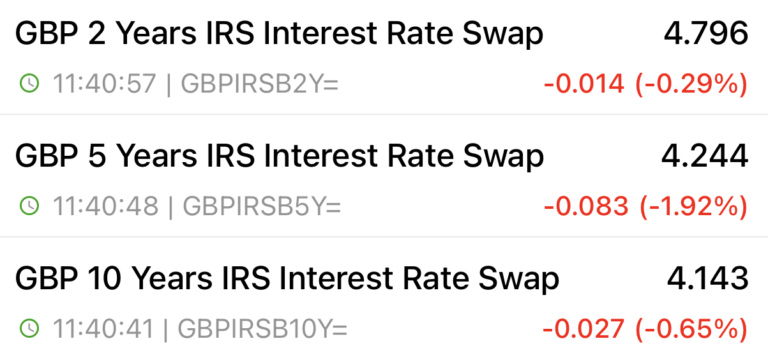

Swap Rates Remain Steady

15th March Swaps

27th February Swaps

If you’re looking for a mortgage, call 0800 0350095 or click on the button below to schedule an apppointment.