Base Rate Battles Inflation while

Swap Rates Shape Mortgage Costs

Mortgage rates are frequently subject to speculation, especially when a notable shift in the Base Rate is currently at a 16-year high of 5.25%. This increase aims to combat inflation, which has significantly declined from 11.1% in October 2022 to 3.2% in March. The central bank’s target inflation rate is 2%.

However, it’s crucial to distinguish between the Base Rate and Swap Rates when considering the potential impact on mortgage rates. While reducing the Base Rate might lead to lower mortgage rates, this isn’t always the case. Various factors influence mortgage rates, including lender costs, risk premiums, and market conditions.

Base Rate - 5.25%

Increasing Base Rate

When the MPC wants to curb inflation, it may increase the base rate. This makes borrowing more expensive for consumers and businesses, reducing spending and investment. Consequently, this helps to dampen demand, which allows for the easing of inflationary pressures.

Decreasing Base Rate

The MPC may lower the base rate to stimulate economic activity and boost inflation. This reduces borrowing costs, encouraging consumers and businesses to borrow and spend more. Increased spending can stimulate economic growth, which helps push inflation towards the target rate.

Swap Rates

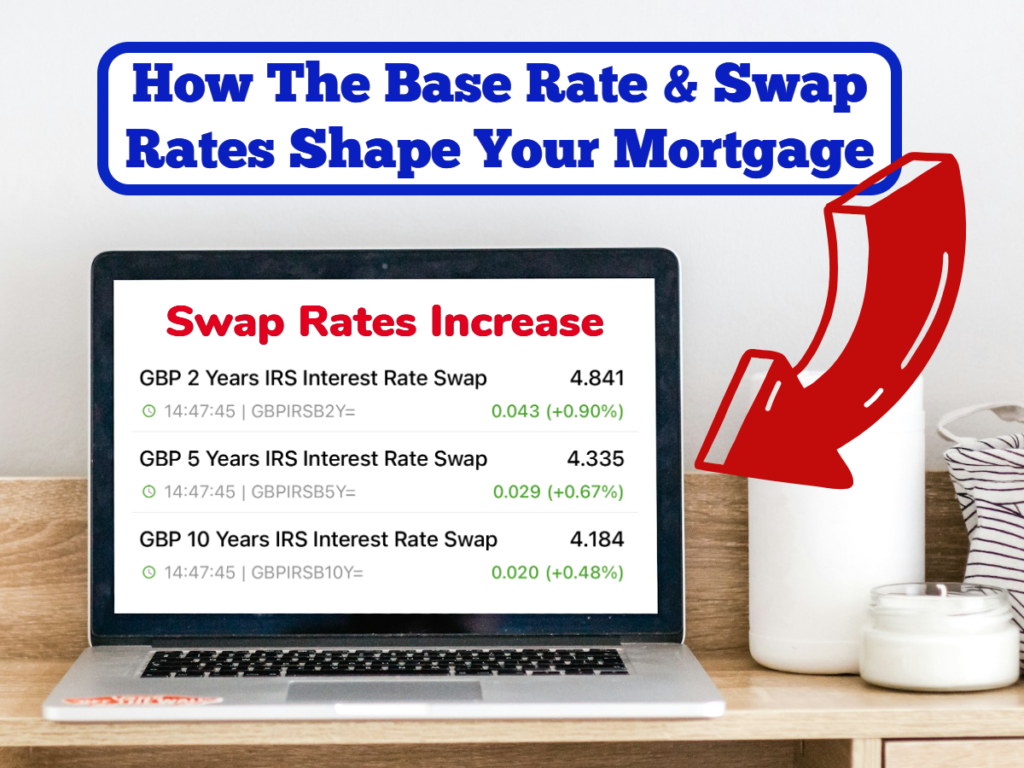

Swap rates are the interest rates banks and financial institutions use when swapping interest rate liabilities with each other. Various factors, including market expectations, economic indicators, and central bank policies influence these rates. Mortgage lenders often use swap rates as a reference when setting the interest rates on offer for mortgage products.

Impact on Mortgage Rates: Changes in swap rates can directly affect the interest rates offered to borrowers. Mortgage lenders typically add a margin to the prevailing swap rate to determine the interest rate they offer to customers. Therefore, when swap rates rise, mortgage rates tend to increase, and vice versa.

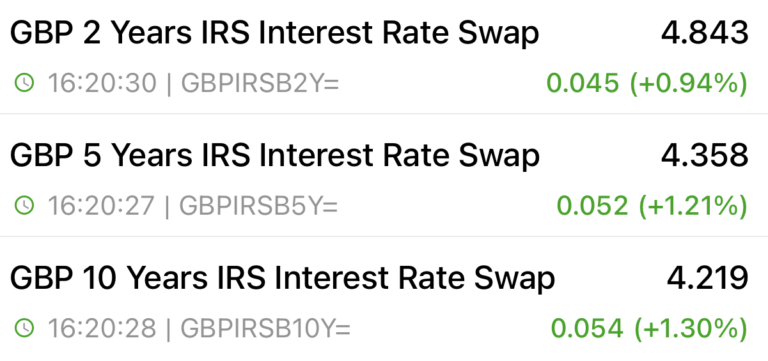

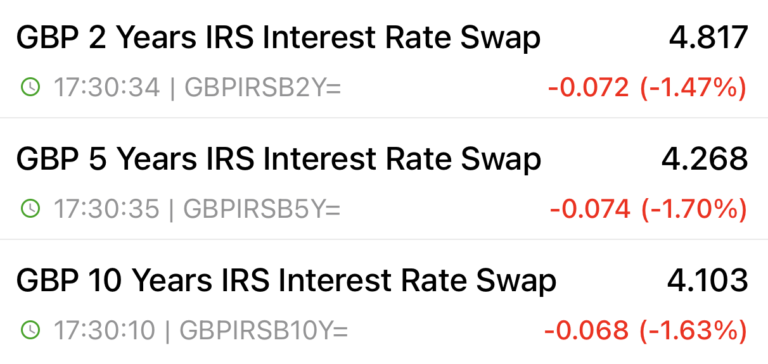

Swap Rates Continue To Rise

23rd April Swaps

15th April Swaps

If you’re looking for a mortgage, call 0800 0350095 or click on the button below to schedule an apppointment.