Rate Reductions Amidst Uncertainty

In a bold move this week, numerous lenders have opted to reduce their rates, aiming to invigorate business volumes in the face of persistent inflationary pressures. Despite reports indicating stubborn inflation, these lenders are betting on rate reductions to stimulate demand and bolster their market share.

The decision comes amidst widespread speculation regarding the trajectory of interest rates, with many analysts suggesting that central banks may refrain from immediate rate cuts. Inflation, characterised by its resilience in recent months, has prompted caution among policymakers, casting doubt on the possibility of imminent monetary easing.

Bank Of England (MPC) Under Pressure

The Bank of England’s Monetary Policy Committee (MPC) faces mounting pressure to modernise its approach to predicting inflation amid speculation over the likelihood of a base rate reduction. Critics have pointed to the MPC’s reliance on traditional models to forecast inflation, highlighting their limitations in capturing the complexities of today’s economic landscape. These outdated methods, they argue, need to account for rapidly evolving market dynamics, technological advancements, and shifting consumer behaviours.

The consequences of such outdated models are becoming increasingly apparent as inflationary pressures persist despite predictions suggesting otherwise. This discrepancy has led to growing scepticism surrounding the accuracy and relevance of the MPC’s inflation forecasts, raising concerns about the efficacy of its policy decisions. The impact of these outdated models on policy decisions fuels speculation over the possibility of a base rate reduction, with economic factors such as inflationary pressures, global economic trends, and geopolitical tensions weighing heavily on the MPC’s decision-making process.

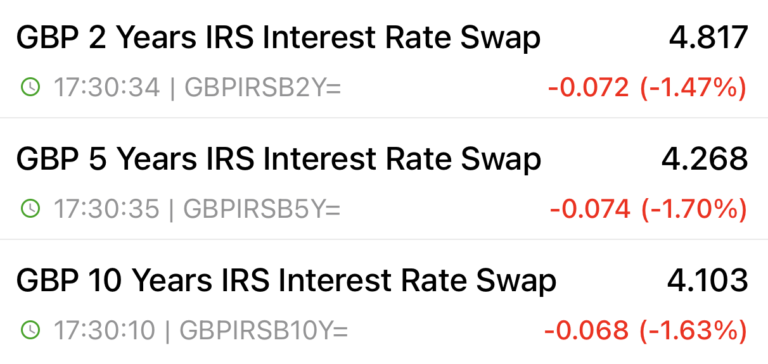

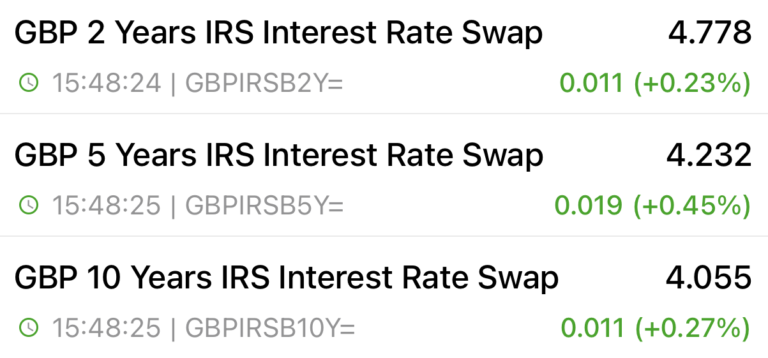

Swap Rates Increase

12th April Swaps

15th March Swaps

If you’re looking for a mortgage, call 0800 0350095 or click on the button below to schedule an apppointment.