Base Rate Held At 5.25%

At todays Bank of England’s (BoE) Monetary Policy Committee (MPC) meeting they voted 7-2 to maintain the current Base Rate at 5.25% for the sixth consecutive month despite inflation falling further to 3.2%.

This decision was followed, as in previous months, by initial promises of an imminent rate reduction. However, caution emerged later in the month as the situation clarified. It is surprising that the Bank of England continues to misjudge the economic pressures and sentiments, especially the risk of stagflation. This is particularly concerning given that Andrew Bailey has admitted that the bank’s own forecasts are unreliable.

The decision to hold the UK Base Rate again aligns the UK with the US Federal Reserve (Fed) decision to hold rates.

Swap Rates Settle

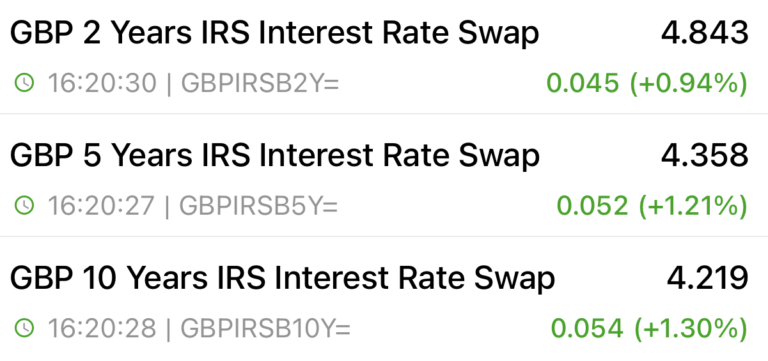

In April 2024, swap rates, which are the rates at which financial institutions exchange fixed interest rate payments for floating rate payments over a specified period, increased sharply. This rapid rise influenced lenders, who depend on these rates to gauge the cost of borrowing on the money markets. As a result, to accommodate the higher costs implied by the rising swap rates, lenders adjusted their mortgage products by increasing mortgage rates several times throughout the month.

However, today’s announcement is expected to have a stabilizing effect on swap rates. When swap rates stabilize, it generally reduces the financial uncertainty for lenders regarding future interest costs. This newfound stability provides lenders with more flexibility to adjust their mortgage rates. Consequently, lenders are likely to slightly reduce their mortgage interest rates in May, making borrowing costs potentially more favorable.

9th May Swaps

23rd April Swaps

Schedule A Mortgage Review

If you want to benefit from the latest rate reductions, call 0800 0350095 or click on the button below to schedule a review.