Base Rate Held At 5.25%

At the first Bank of England’s (BoE) Monetary Policy Committee (MPC) meeting in 2024, they unsurprisingly voted 6-3 to maintain the current Base Rate at 5.25% for a fourth consecutive month, backed by the objective to bring inflation down to meet their 2% target.

The decision to hold the UK Base Rate again aligns the UK with yesterday’s decision made by the US Federal Reserve (Fed).

Inflation Warning

The Governor of the BoE, Andrew Bailey, said the MPC believe holding the Base Rate remains appropriate given their forecasts for inflation are that it will fall to around 3% in March and then close to the 2% target around April, May & June before “increasing somewhat” over the second half of the year.

If the MPC inflation forecast turns out to be accurate, it will likely stall any rate cuts until 2025 after the General Election.

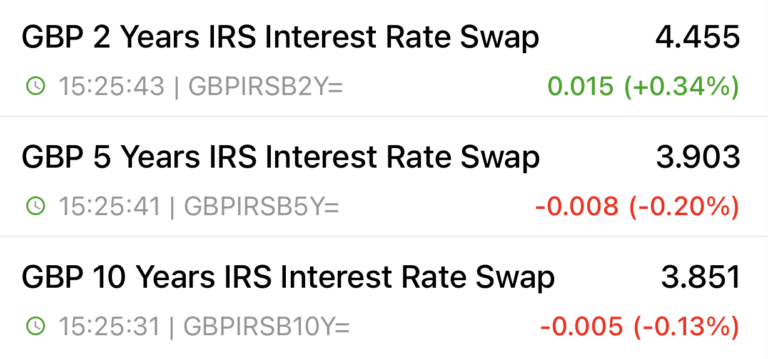

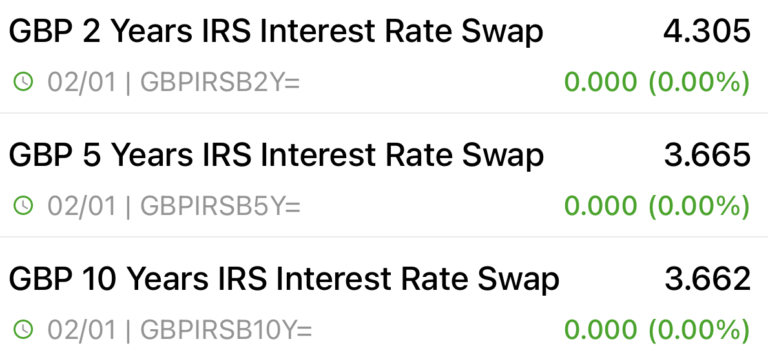

Swap Rates Settle - Lenders Increase Rates

In the highly competitive mortgage landscape, January 2024 emerged as a prime time for borrowers. As lenders vied for a larger slice of the market by slashing interest rates, this aggressive strategy began to shift. Notably, some financial institutions, including Nationwide, have signaled a change in direction by announcing rate hikes of up to 0.3% starting tomorrow. This suggests that the current period of advantageous borrowing conditions could be drawing to a close.

1st February Swaps

4th January Swaps

Schedule A Mortgage Review

If you want to benefit from the latest rate reductions, call 0800 0350095 or click on the button below to schedule a review.