Mortgage Rates Under Pressure

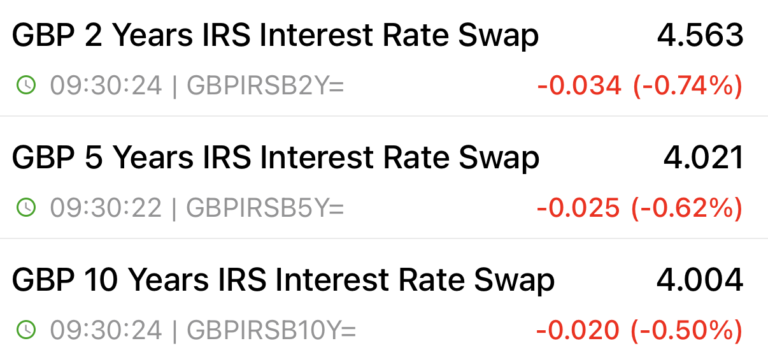

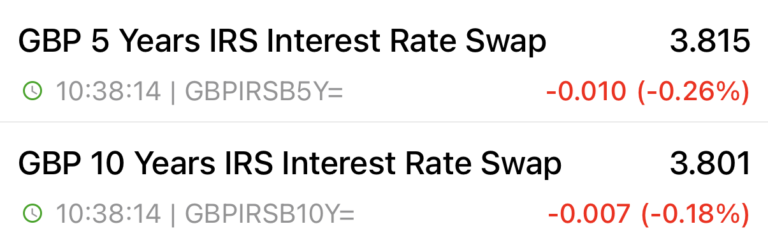

The swift rise of swap rates to over 4% marks a critical juncture for the mortgage industry. This increase elevates the cost of borrowing for lenders, directly impacting their profit margins. Fueled by intense competition, the recent trend of reducing mortgage rates faces a sustainability crisis. Lenders can only maintain these low rates by incurring significant financial strain. This shift could lead to an inevitable increase in mortgage rates, cooling the competitive enthusiasm and potentially altering consumer borrowing behaviour. It’s a stark reminder of the intricate balance between market competition and underlying financial market dynamics that will play out over the coming weeks and months.

Window Of Opportunity

In this fiercely competitive mortgage market, January 2024 presents a golden opportunity. With lenders aggressively driving down rates to capture market share, this could be your chance to secure the most affordable mortgage of the year. The looming General Election is expected to stir economic turbulence, potentially affecting interest rates. By reviewing and refinancing your mortgage now, you can lock in these low rates before the political landscape shifts the economic tide in this current window of opportunity.

24th January Swaps

16th January Swaps

If you’re looking for a new or considering a review of your existing mortgage to benefit from the recent rate reductions, call 0800 0350095 or click on the button below to schedule a review apppointment.