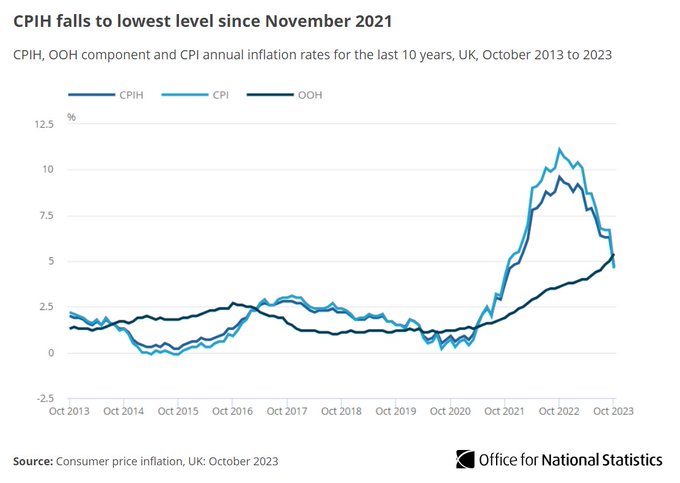

The Office for National Statistics (ONS) released figures today showing better-than-expected figures for inflation, which fell sharply from 6.7% in September to 4.6% in October. The sharp fall in inflation is mainly attributed to another fall in energy prices.

The sharp fall in inflation justifies the Bank of England (BoE) Monetary Policy Committee’s decision to hold the Base Rate at 5.25% earlier this month. Still, worryingly, three members voted to increase the base rate despite massive pressure on households throughout this year with the rising cost of living.

The pain may continue with the Bank of England (BoE) again confirming their inflation target is 2%, not sub 5%. It is too early to start talking about cuts to the base rate.

Swap Rates Down - Mortgage Rate Cuts On The Way ?

The Swap Rate tables below show another significant reduction, with long-term swaps being the biggest winners, five and ten-year swaps falling by more than 5% in the last two weeks. This shows confidence in the financial markets likely to be reflected in further mortgage rate reductions in the coming days. With lenders considering their market share and targets, seeing how competition shapes the mortgage arena in the first quarter of 2024 will be interesting.

15th November Swaps

2nd November Swaps

We are booking new products six months before the end of the current mortgage and then reviewing them monthly until completion. If you want your mortgage reviewed and want to benefit from the latest rate reductions, call 0800 0350095 or click on the button below to schedule a callback.