Bank of England Hold Rate At 5.25% – What Effect On Mortgages?

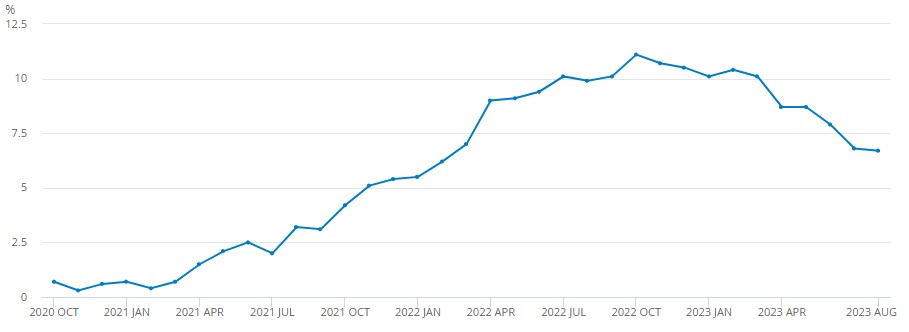

Today, the Bank of England (BoE) Monetary Policy Committee voted by a narrow majority of 5-4 to hold the Base Rate at 5.25% despite yesterday’s 6.7% inflation announcement that fuelled speculation that a 15th consecutive increase was highly likely. The decision to hold the rate will likely result from a slowing economy and its broader […]

Bank of England Hold Rate At 5.25% – What Effect On Mortgages? Read More »