Bank of England Cuts The Base Rate By 0.25%

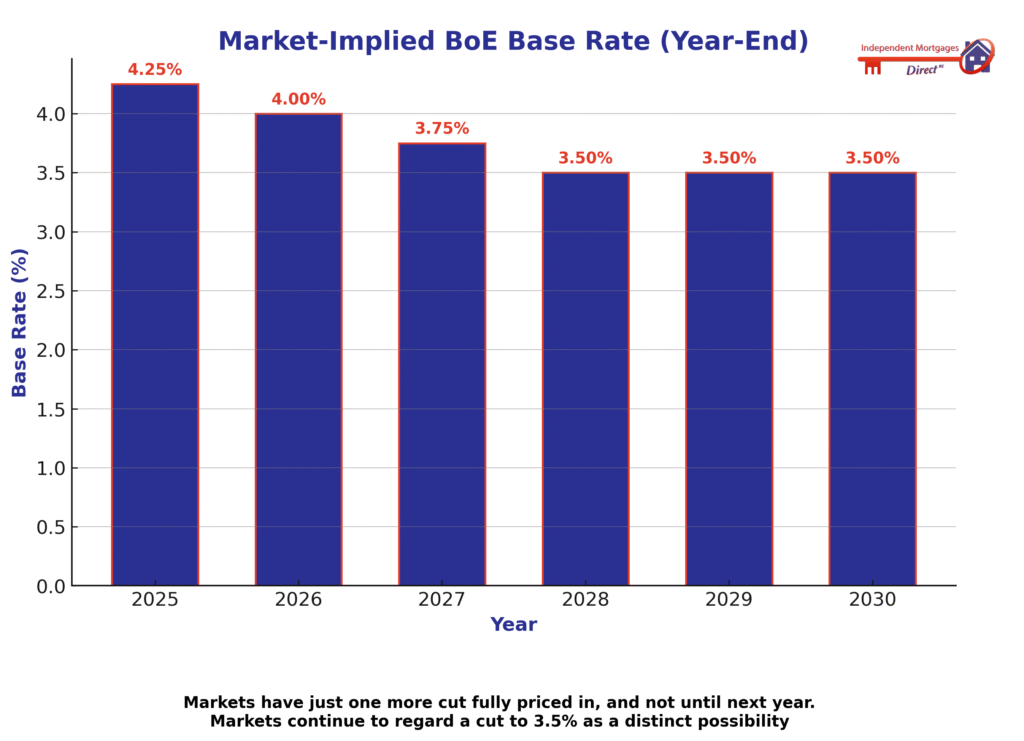

Base Rate – 3.75% The Bank of England has reduced the base rate to 3.75%, the lowest level in nearly three years, reflecting a slowing UK economy. Inflation has eased from recent highs, wage growth is moderating, and economic output has weakened, prompting the Monetary Policy Committee to cautiously support growth. While inflation remains above […]

Bank of England Cuts The Base Rate By 0.25% Read More »