Mortgage Rates Fall

As we step into 2024, the mortgage lending sector is witnessing an intense battle for market share. This competition is unfolding against a backdrop of global financial pessimism, heavily influenced by current UK and world events. The uncertainty surrounding these events is shaping monetary policies, adding layers of complexity to an already competitive market.

With the Bank of England grappling with inflationary pressures and other central banks following suit, interest rates are in flux. This intensified competition is directly impacting mortgage rates, influencing consumer behaviour and lender strategies.

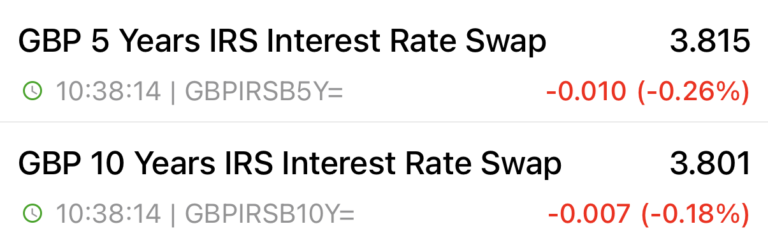

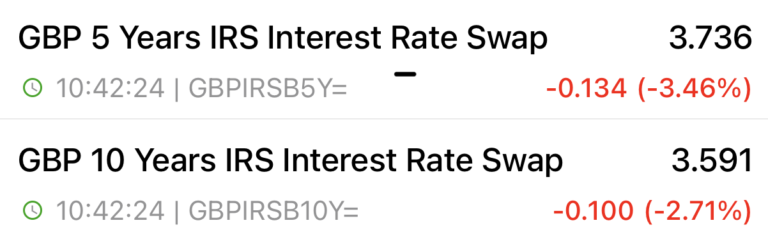

Five & Ten Year Swap Rates Rise

While competition among lenders is driving down interest rates, swap rates are on an upward trajectory. This divergence presents a sustainability challenge. As lenders vie for customers by offering attractively low rates, the rising cost of borrowing on the swap market squeezes their margins. If swap rates continue their ascent, this situation could become untenable. Lenders might face the tough choice of increasing interest rates, this delicate balancing act highlights the complexities of the current mortgage landscape.

16th January Swaps

20th December Swaps

If you’re looking for a new or considering a review of your existing mortgage to benefit from the latest rate reductions, call 0800 0350095 or click on the button below to schedule a review apppointment.