Tracker Mortgages - Time to Get Out?

Economists and financial experts analysing the mortgage market recommend that now might be the best time to switch from a variable-rate mortgage. This advice comes after approximately 77,900 homeowners opted for variable-rate mortgages in 2023, the highest number since 2017. Currently, the lowest available tracker mortgage rate is 5.39%, whereas fixed-rate mortgages start at 4.09%.

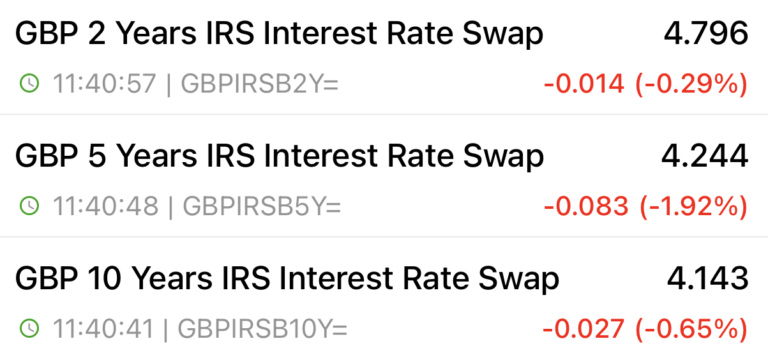

The rapid increase in swap rates to above 4% represents a significant turning point for the mortgage sector. This rise raises the borrowing costs for lenders, affecting their profitability.

Have The Bank Of England Waited Too Long To Cut Rates

The debate over whether the Bank of England (BoE) has delayed its decision to lower interest rates in the face of persistent inflation requires a detailed examination of the economic landscape, inflation trends, and the central bank’s policy actions. BoE Governor Andrew Bailey informed the Treasury Select Committee that the UK’s economic downturn might have ended, pointing to clear signs of recovery. He also mentioned that a reduction in interest rates was expected later.

The current situation is characterised by a base interest rate of 5.25% against a predicted inflation rate of 4%, resulting in a significant impact of 1.25%. However, if inflation approaches the target of 2.7% before the end of 2024, the gap—reflecting the economic strain—would widen to 2.55%, making a case for lowering interest rates.

The Office for National Statistics (ONS) is set to release its next set of inflation data on March 20th, which will be closely followed by a meeting of the BoE’s Monetary Policy Committee (MPC) on March 21st. Should the inflation rate fall below 4%, there will be a strong case for the MPC to consider reducing the base interest rate to align with the new data.

27th February Swaps

1st February Swaps

If you’re looking for a new or considering a review of your existing mortgage to benefit from the recent rate reductions, call 0800 0350095 or click on the button below to schedule a review apppointment.