Base Rate Held At 5.25%

The Bank of England (BoE) Monetary Policy Committee voted again today to hold the Base Rate at 5.25% for the third consecutive month amidst concerns that stubborn inflation remaining more than double the BoE’s 2% target is starting to affect the wider economy with fears of a protracted slump or recession

The decision to hold the UK Base Rate again aligns the UK with yesterday’s decision made by the US Federal Reserve (Fed).

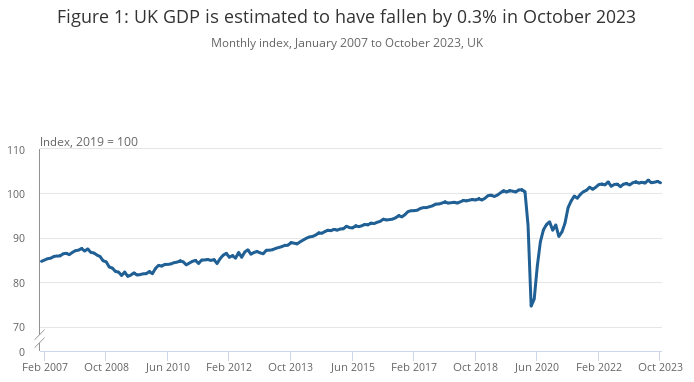

GDP Flat For 3 Months

It was confirmed the economy shrank unexpectedly with gross domestic product (GDP) flat in the three months to October falling by 0.3% according to the Office for National Statistics (ONS).

Concerns remain that the risk of a slowing economy may have an adverse effect on the jobs market into 2024 as the fear an economic slowdown could turn into a recession.

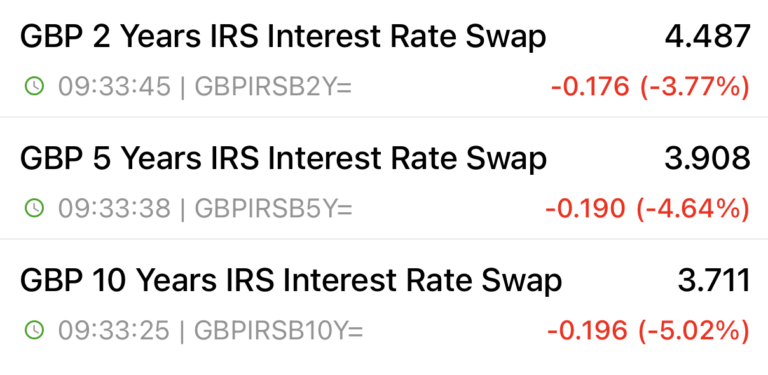

NOTE - 5 & 10 Year Swap Rates Fall Below 4%

You can see from the Swap Rate tables below that there has been a significant reduction over the last two months from September to the present, which explains the recent positive adjustments lenders made last month to mortgage rates on offer. However, it also highlights the speed at which rates are moving and the fragility of a market that could impact either way depending upon the next steps taken by the Government and BoE.

December Swaps

September Swaps

Start Saving In 2024 With A Free Mortgage Review

If you want to benefit from the latest rate reductions, call 0800 0350095 or click on the button below to schedule a review.