What You Need To Know

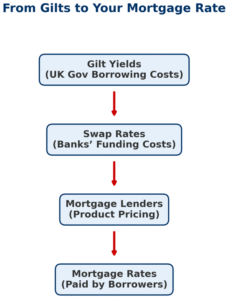

When you hear “gilt yields are rising,” it may sound technical, but the effect is simple – higher mortgage costs. Gilts (UK government bonds) drive swap rates, which in turn dictate how lenders price fixed-rate mortgages. With gilt yields now at levels not seen since the 1990s, mortgage rates are under pressure again. For borrowers, that means if your fixed deal is ending soon, your repayments could rise sharply. Acting early could lock in a lower rate and protect you from further increases, while waiting could mean paying far more than necessary.

Gilt Yields, Swaps & Your Mortgage

📈 Gilts are the UK government’s bonds. When investors want higher returns, gilt yields rise.

🔄 Swap rates (2-, 5-, 10-year etc.) are what banks use to fix the cost of lending to each other, and mortgage lenders base fixed-rate pricing on these.

Even if the Bank of England base rate stays the same, gilt and swap movements can still make mortgages more expensive.

Swap Rates Climb Again – What Rising Costs Mean for Your Mortgage

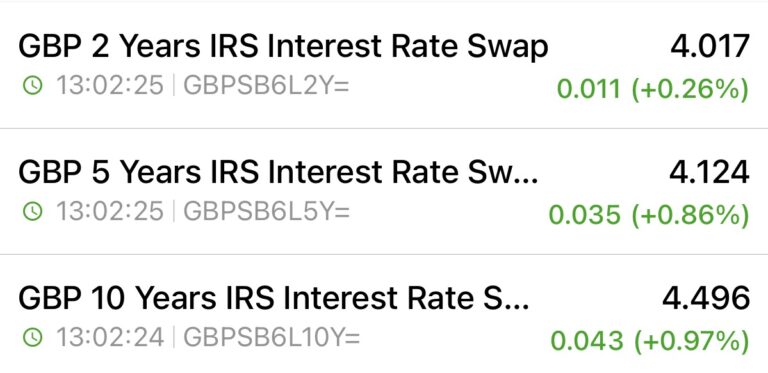

Since early August, swap rates—the benchmark for fixed-rate mortgages—have been rising (see below). This is driven by higher UK gilt yields, inflation concerns, public spending, and global bond market pressures. For borrowers, higher swap rates mean lenders’ costs rise, pushing mortgage rates up. Even a small 0.2–0.3% increase on a £100,000 mortgage could add £15–£25 per month, so if your fixed deal ends within 6–12 months, it may be wise to act early to secure a new rate before costs rise further.

2nd September Swaps

7th August Swaps

Find The Best Mortgage Deal

Searching for the right mortgage can feel overwhelming, but comparing rates is the smartest way to get started. Our free whole-of-market comparison tool makes it easy to view the latest mortgage rates from across the UK, so you can choose a deal that truly fits your budget and goals.

Take control of your mortgage search today and discover how much you could save. When you’re ready, our experienced advisers are here to guide you every step of the way and help secure the most suitable deal for your circumstances.

Pay Your Mortgage Off Early

The Mortgage Overpayment Calculator is designed to simplify your financial planning by showing how extra payments can reduce your mortgage balance and help you pay off your loan faster. Whether you make regular monthly contributions or a one-time lump sum, overpayments can lead to substantial interest savings and faster debt reduction.

With just a few details, you can instantly visualize your savings and adjust your timeline. The calculator’s precise results show how even modest overpayments can bring you closer to financial freedom.