Swaps Rise As Lenders Consider Rate Increases

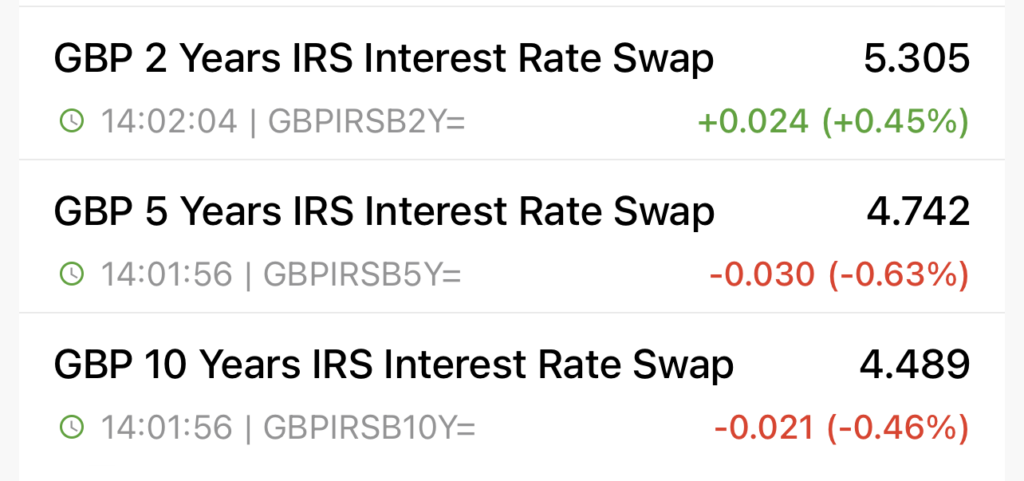

Swap Rates 12/10/23

Swap Rates 27/10/23

Swap Rate Increase

The five and ten-year Swap Rates worryingly increased steadily this week as UK inflation holds at 6.7%. Lenders are watching the markets and waiting for next week’s Bank of England decision, but some have chosen to increase their rates before the announcement.

Bank of England Decision

Markets anticipate the Bank of England will hold rates at the current 5.25% when they meet next Thursday but have warned their decision is finely balanced and will be “tight” following the September 5-4 split that rates will remain higher for longer due to the strength of pay increases and the jobs market.

The International Monetary Fund (IMF) has forecast that UK interest rates will peak at 5.5% and remain at that level throughout 2024 due to high inflation and slow growth.

If you are looking to move home or coming to the end of your current mortgage product deal call 800 0350095 to discuss your requirements with one of our experienced Mortgage Advisers or click on the button below to schedule a call back at a convenient time.