Swap Rate Volatility, Mortgage Rate Reductions

and House Prices Fall

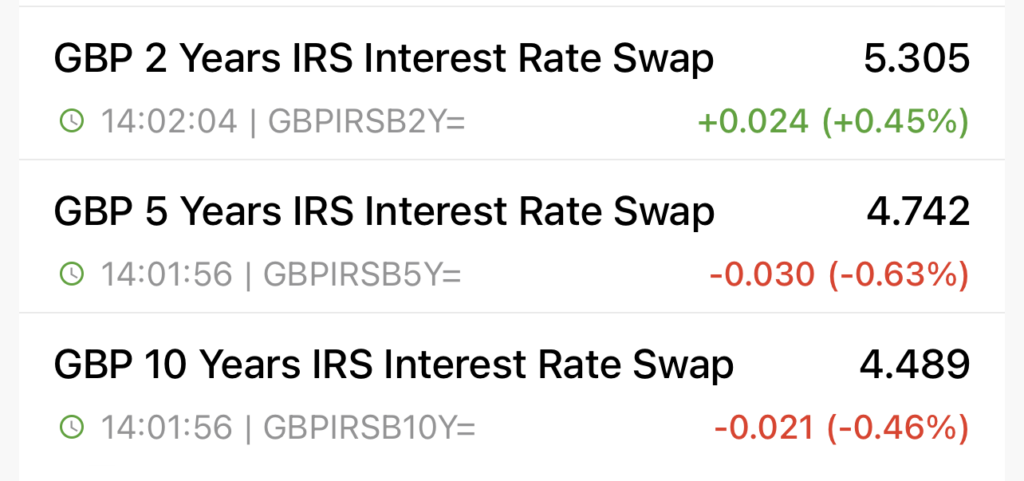

Swap Rate Volatility

Volatility in the swap market continues, with 2-year swaps increasing slightly while 5 and 10-year swaps continue to fall, implying market expectations that interest rates will remain higher for longer.

More Lenders Reduce Rates

Mortgage approvals for house purchase and re-mortgage transactions fell from 88,800 to 70,400 in August, which is the lowest level in the same period since 2012. This is a significant indicator in the current climate because, when combined with the 5 and 10-year swap rate reductions, it is likely to be the reason lenders continue to offer further mortgage rate reductions to bring much-needed confidence to the market with increased competition that is great news if you are looking to move home or coming to the end of your current mortgage product deal period looking to secure a new rate.

House Prices Fall

Halifax reported house prices fell by -0.4% monthly in September 2023, while annual house prices declined by -4.7% compared to -4.5% in August 2023. A typical home in the UK now costs £278,601, a pricing level last seen in early 2022.

If you are looking to move home or coming to the end of your current mortgage product deal call 800 0350095 to discuss your requirements with one of our experienced Mortgage Advisers or click on the button below to schedule a call back at a convenient time.