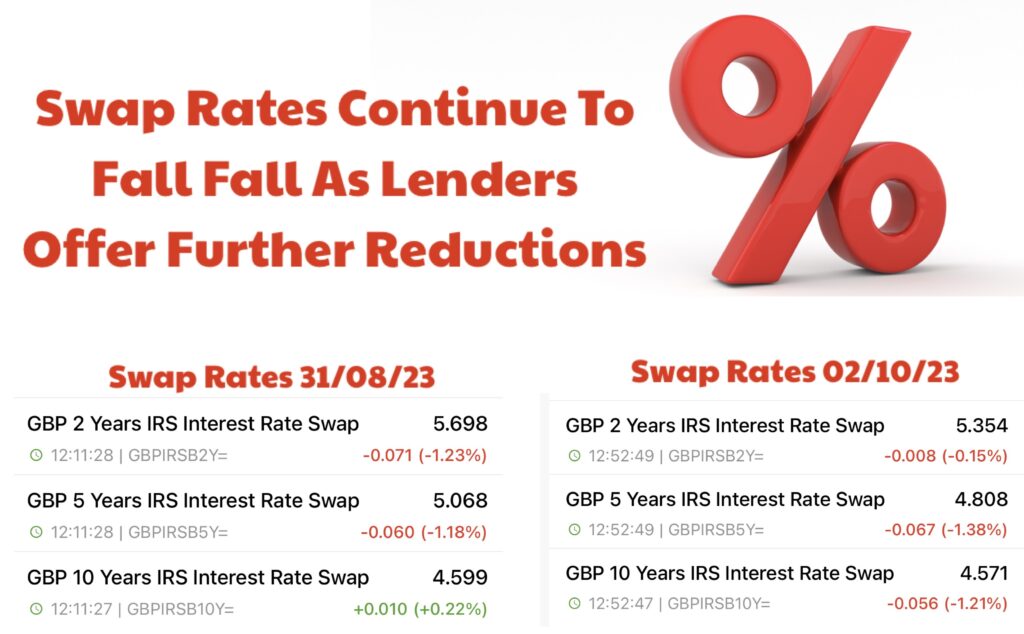

Inflation Falls Below 4% And Swap Rates Continue To Fall

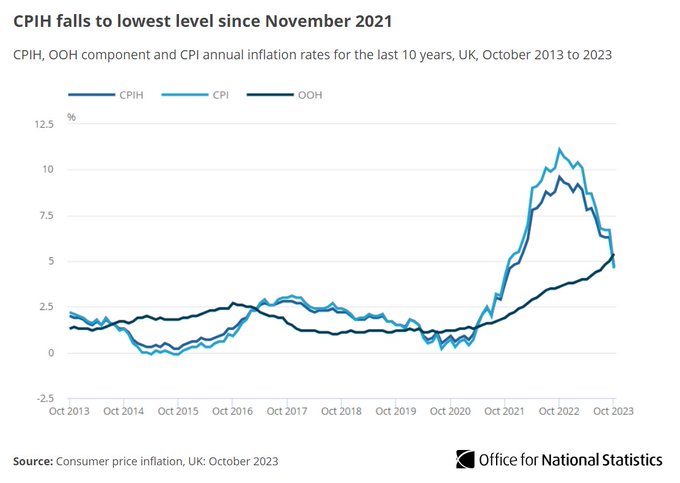

Inflation Falls Below 4% The Office for National Statistics (ONS) announced today that Consumer Prices Index (CPI) annual inflation fell from 4.6% in October to 3.9% in November and is now at its lowest for over two years. Inflation below 4% is great news to end a turbulent year and should continue to ease the […]

Inflation Falls Below 4% And Swap Rates Continue To Fall Read More »