Competition Drives Rate Reductions

The Budget brought no surprises for the mortgage market, and lenders had already adjusted pricing in advance. With swap rates — the key driver of fixed-rate costs — largely unchanged, there’s been no immediate pressure to reprice.

Any near-term changes are expected to be competitive rather than economic, driven by lenders managing year-end targets and market share. Overall, the Budget has created stability, not volatility, and any new products next week are likely to be tactical rather than market-driven.

Swap Rates Edge Lower

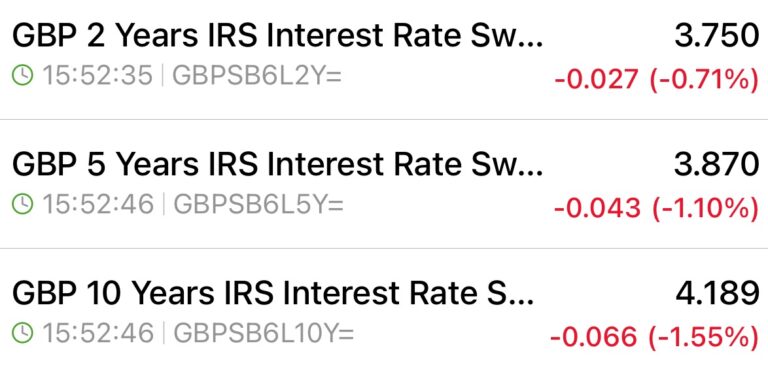

Swap rates have fallen meaningfully through November, reducing lenders’ funding costs and encouraging sharper pricing. Between 6th and 28th November, 2-year swaps fell by around 7.6% and 5-year by 5.9%, as shown below. These are significant movements and are already prompting lenders to make small, frequent reductions to stay competitive. With funding costs easing and more lenders adjusting pricing, now is an excellent time to review your mortgage to ensure you’re not missing out on the improved options coming to market.

28th November Swaps

6th November Swaps

Should You Review Your Mortgage Now?

For anyone due to remortgage in the next six to twelve months, early planning remains key. At IMDNE, we continually monitor lender rates right up until completion. If a lower rate becomes available, we automatically secure the improved deal, ensuring you never miss out on better terms.