BoE Holds Base Rate at 4% - Why ?

The Bank of England interest rates 2025 decision has seen the base rate held at 4%, as the Monetary Policy Committee voted to keep borrowing costs unchanged. For homeowners and buyers, this move highlights ongoing inflation concerns. Mortgage borrowers should consider whether their current deal remains competitive, as even small changes in rates can affect repayments. Book a Free Mortgage Review to ensure you’re on the right deal.

The Bank is signalling caution. Inflationary pressures remain, with energy costs, wage growth, and global trade tensions keeping prices under scrutiny. Rising unemployment, now at a four-year high, adds further pressure on household finances and dampens growth prospects. Although markets expected the hold, the Bank has also slowed the pace of quantitative tightening, reflecting concerns about wider economic stability.

What the BoE Decision Means for Mortgage Borrowers

For anyone on a variable or tracker mortgage, repayments remain directly linked to the 4% base rate. Fixed-rate borrowers may be shielded for now, but deals are due to expire, and refinancing at the right time is crucial. Use our Mortgage Overpayment Calculator to see how small extra payments could reduce your balance and interest costs.

Should You Review Your Mortgage Now?

Yes. With inflation risks still present and November’s Budget likely to influence the market, now is the right time to assess your options. A short-term deal may offer flexibility while economic uncertainty continues. Use the link below to our Mortgage Comparison Tool, linked to live lender data, to see the latest deals available and compare mortageg products. Then Book a Free Mortgage Review to explore the most suitable solutions for your circumstances.

Late Appointments Now Available

Flexible appointments with one of our experienced advisers are available until 7pm, we make it easier than ever to fit mortgage advice into your busy schedule. With todays reduction in the base rate and 2025 predicted to be on of the busiest years yet, securing your spot early is essential.

Don’t wait to take control of your finances and start the year with confidence and peace of mind. Contact us today to explore your options and ensure you’re set up for success. Lets make your property goals a reality.

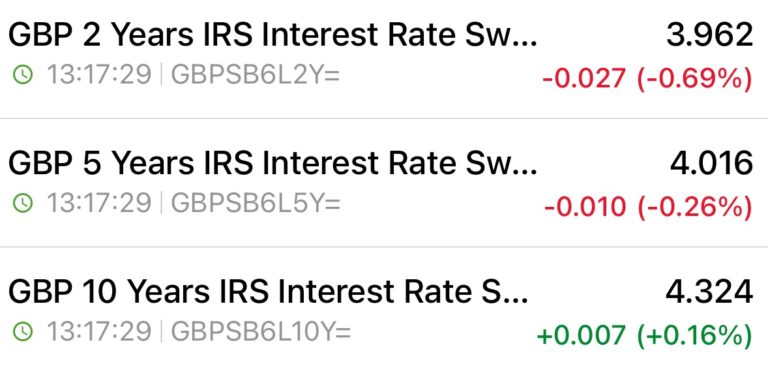

Short-Term Swaps Stabilise

This shift in swaps shown below is due to markets expecting interest rates to remain stable for longer, with less upward pressure from inflation – assuming this is kept under control. The narrowing gap between short- and medium-term swaps suggests that, for some borrowers, a shorter-term deal may be more appropriate while waiting to see how the economic picture develops. It is also important to note that November’s Budget could significantly influence this outlook, depending on fiscal policy, taxation, and business cost measures announced.

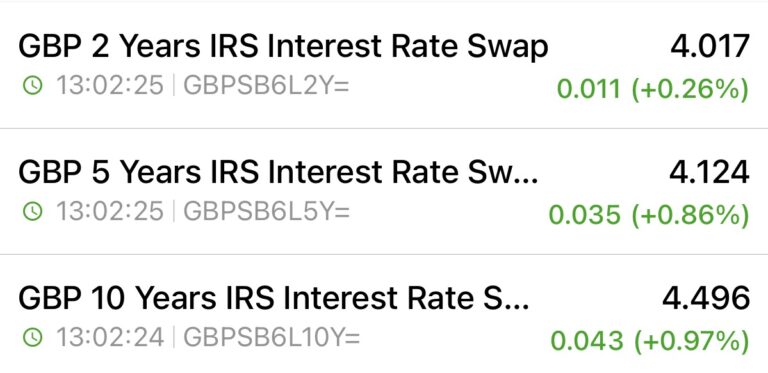

18th September Swaps

2nd September Swaps