Borrowers & Base Rates

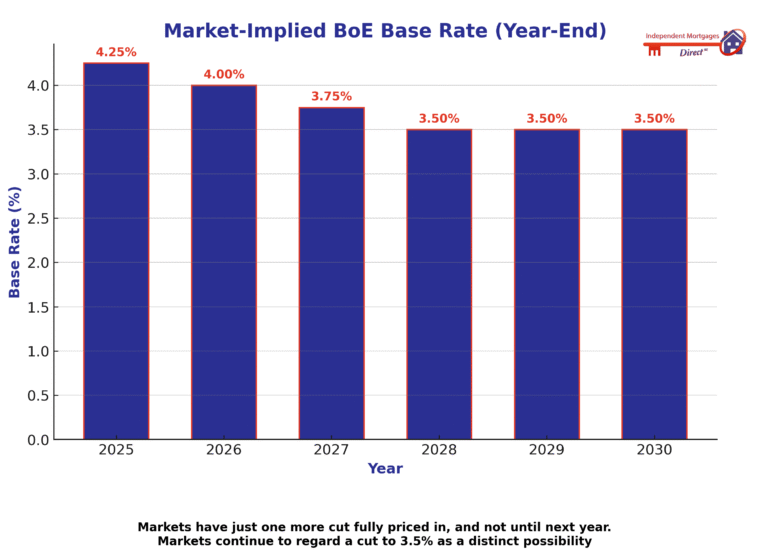

Markets currently expect just one further Bank of England base rate cut, with a move towards 3.5% considered possible next year. This limited outlook reflects persistent inflationary pressures, cautious economic growth, and the Bank’s reluctance to ease too quickly. For borrowers, this means mortgage rates may remain higher for longer than many had hoped. Those on variable or tracker deals could see less relief, while fixed-rate borrowers face fewer opportunities to refinance at significantly lower costs. Careful planning is essential—reviewing options early can help secure stability and protect against potential market volatility.

Swap Rate September Swing

September saw noticeable shifts in swap rates, reflecting changing market sentiment. Early in the month, optimism grew that inflationary pressures were easing, leading to a slight fall in rates as markets anticipated a more cautious Bank of England. Mid-month, swaps reached their lowest point as this narrative strengthened. However, towards the end of September, renewed global market pressures and lingering concerns over inflation reversed the trend, pushing swaps higher again.

For borrowers, this volatility underlines the importance of timing and flexibility. Shorter-term mortgage products remain sensitive to market moves, while longer fixes offer stability but at elevated levels.

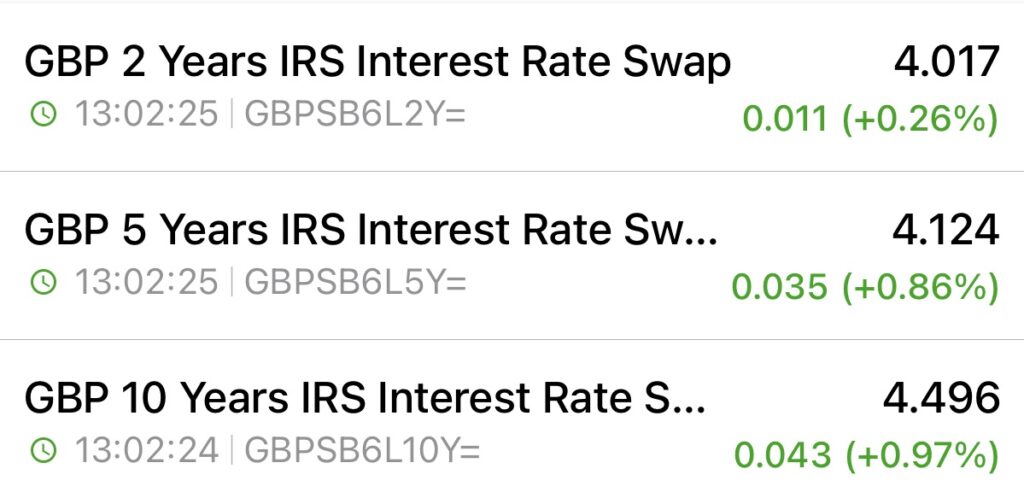

27th September Swaps

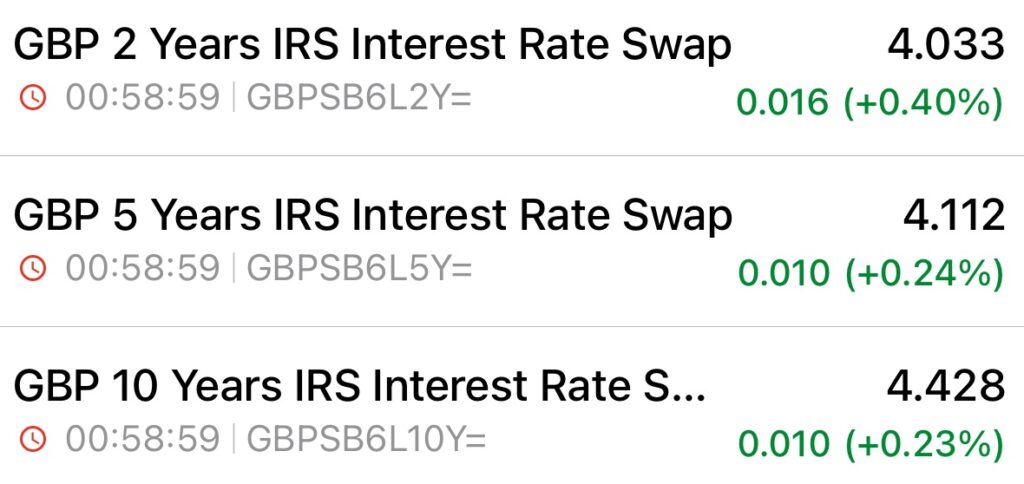

18th September Swaps

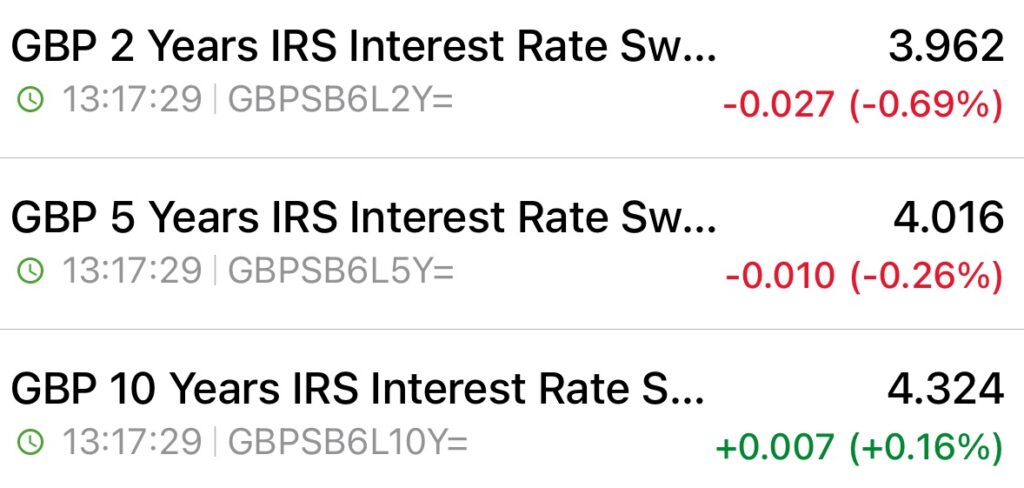

2nd September Swaps

Should You Review Your Mortgage Now?

With only limited base rate cuts expected and swap rates swinging, borrowers face continued uncertainty. Mortgage costs may stay higher for longer, leaving fewer opportunities to secure lower deals. Tracker borrowers may see modest relief, while fixed-rate clients could find refinancing options restricted. Now is the right time to review your mortgage. Acting early can lock in stability, manage costs, and protect you from further volatility.

Speak to one of our highly rated, experienced advisers today — or use the buttons below to compare rates or book your free review.