Base Rate Hold - Close Call !

The Bank of England has held the base rate at 4% following a close 5–4 vote, marking its second consecutive pause as policymakers await the Autumn Budget and further progress on inflation. The decision signals continued stability, offering reassurance to homeowners after a turbulent period for interest rates. Those with mortgage deals ending in 2026 are likely to experience a gentler landing than once feared, with fixed rates already easing in anticipation of future cuts.

What the Autumn Budget Means for Homeowners

For homeowners, the upcoming Budget is significant. Any move by the Chancellor to tighten fiscal policy — such as reducing government spending or adjusting taxation — could help slow inflation, allowing the Bank more room to reduce rates sooner. Conversely, if the Budget includes new spending commitments or tax cuts, inflationary pressure could persist, delaying rate reductions. Either way, the decision signals stability after two years of uncertainty.

Should You Review Your Mortgage Now?

For anyone due to remortgage in the next six to twelve months, early planning remains key. At IMDNE, we continually monitor lender rates right up until completion. If a lower rate becomes available, we automatically secure the improved deal, ensuring you never miss out on better terms.

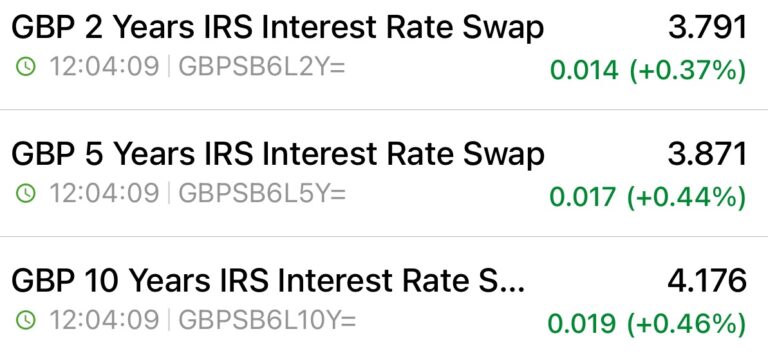

Short-Term Swaps Fall

Swap rates have fallen as markets now expect the Bank of England’s next move to be a rate cut rather than a rise. Softer inflation, weaker growth, and a cooling labour market have eased pressure on policymakers, reducing future rate expectations. As swaps reflect lenders’ hedging and funding costs, lower swap rates mean cheaper wholesale funding. Lenders are now gradually passing this on through lower fixed-rate mortgage products, particularly on two- and five-year deals. This shift signals improving stability and offers borrowers a timely opportunity to secure more competitive rates.

6th November Swaps

27th September Swaps