What You Need To Know

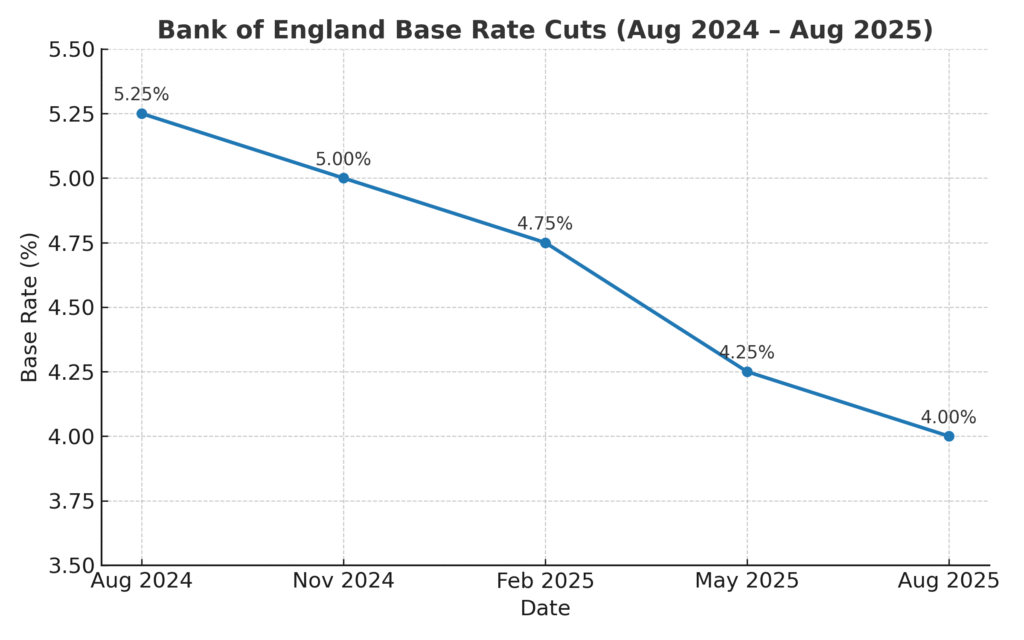

The Bank of England (BoE) reduced the Base Rate by 0.25%, bringing it down to 4.00% – It’s lowest level since March 2023.

This is the fifth cut since August 2024 and was narrowly approved in a 5–4 split vote, marking the first time in history that the Monetary Policy Committee (MPC) required two voting rounds to reach a decision.

The BoE is moving cautiously, signalling that while more cuts are possible, they are likely to be gradual. Market forecasts suggest rates could reach 3% by 2026, but this will depend on inflation trends.

Why The Rate Was Cut

Economic Slowdown

- UK GDP contracted by 0.1% in May.

- Labour market data shows softening demand for workers.

- Global slowdown signals – including weak US jobs data – increased pressure to ease.

Inflation Concerns

- Inflation currently sits at 3.6%, above the BoE’s 2% target.

- Rising food prices could push inflation back up towards 4%, limiting the scope for rapid further cuts.

MPC Dynamics

- The close vote reflects differing views within the Bank on balancing economic support with inflation control.

Short-Term Swaps Fall

Since June, UK swap rates – which heavily influence the pricing of fixed-rate mortgages – have remained broadly stable, with a modest downward shift. This stability provides lenders with greater pricing certainty and supports the gradual reduction in fixed-rate mortgage products seen across the market. The slight easing in swap rates reflects improved inflation expectations and market confidence in the Bank of England’s measured approach to monetary policy. As a result, borrowers may start to benefit from more competitive fixed-rate deals in the months ahead, even if base rate cuts remain slow and deliberate.

7th August Swaps

20th June Swaps

Find The Best Mortgage Deal

Searching for the right mortgage can feel overwhelming, but comparing rates is the smartest way to get started. Our free whole-of-market comparison tool makes it easy to view the latest mortgage rates from across the UK, so you can choose a deal that truly fits your budget and goals.

Take control of your mortgage search today and discover how much you could save. When you’re ready, our experienced advisers are here to guide you every step of the way and help secure the most suitable deal for your circumstances.