Base Rate - 3.75%

The Bank of England has reduced the base rate to 3.75%, the lowest level in nearly three years, reflecting a slowing UK economy. Inflation has eased from recent highs, wage growth is moderating, and economic output has weakened, prompting the Monetary Policy Committee to cautiously support growth. While inflation remains above the 2% target, policymakers judged that conditions now justify a gradual easing of monetary policy. This decision is intended to lower borrowing costs, improve affordability, and support confidence, with future cuts dependent on economic data.

Swap Rates - 2026 Outlook

Short-term swap rates moved only slightly because the base-rate cut was already priced in by the markets following the Autumn Budget. Lenders and investors had anticipated this decision, so pricing had adjusted in advance rather than reacting sharply on the day.

Looking ahead to 2026, markets expect a gradual path of further reductions, not rapid cuts. Inflation is easing but remains above target, so the Bank of England is likely to move cautiously. If inflation and wage growth continue to cool, swap rates could drift lower, supporting improved mortgage pricing over time rather than sudden drops.

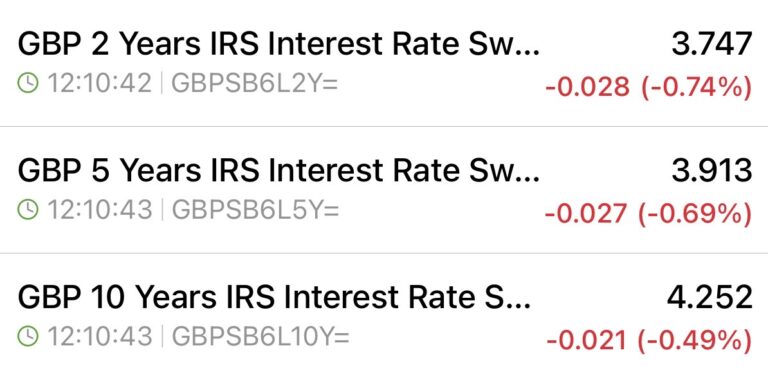

18th December Swaps

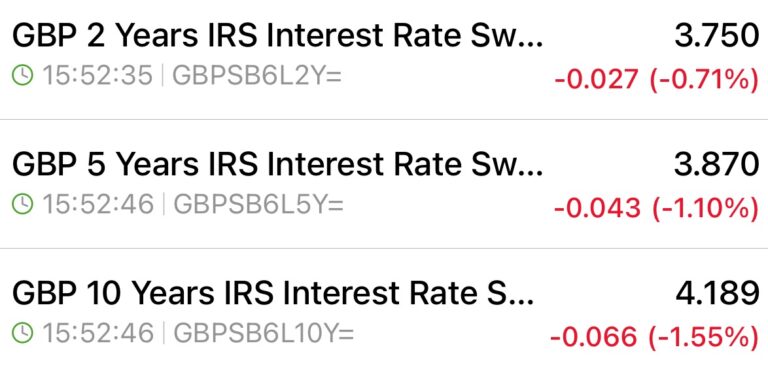

28th November Swaps

Should You Review Your Mortgage Now?

For anyone due to remortgage in the next six to twelve months, early planning remains key. At IMDNE, we continually monitor lender rates right up until completion. If a lower rate becomes available, we automatically secure the improved deal, ensuring you never miss out on better terms.