Autumn Statement – Chancellor Forecasts Sub 2% Inflation In 2025

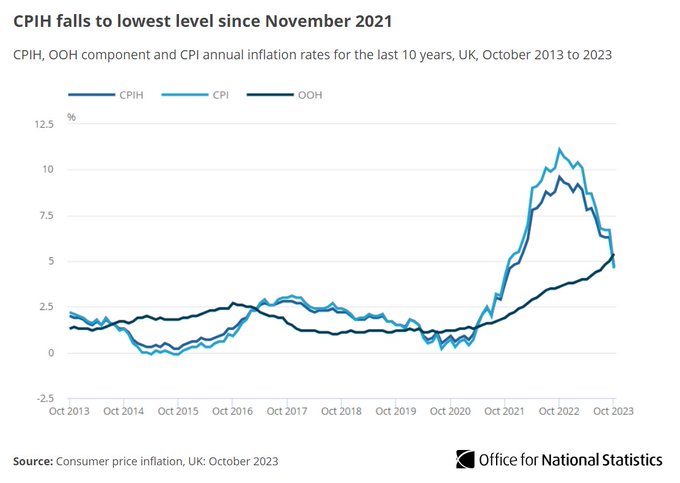

Inflation Forecast In today’s Autumn Statement (for Growth), Chancellor Jeremy Hunt said the Government was on track to reducing debt, cutting taxes, and controlling inflation. With inflation down from 11.1% when he and Prime Minister Rishi Sunak took office to 4.6%, he went on to say the Office for Budget Responsibility (OBR) has forecast inflation […]

Autumn Statement – Chancellor Forecasts Sub 2% Inflation In 2025 Read More »