Independent Mortgages Direct NE

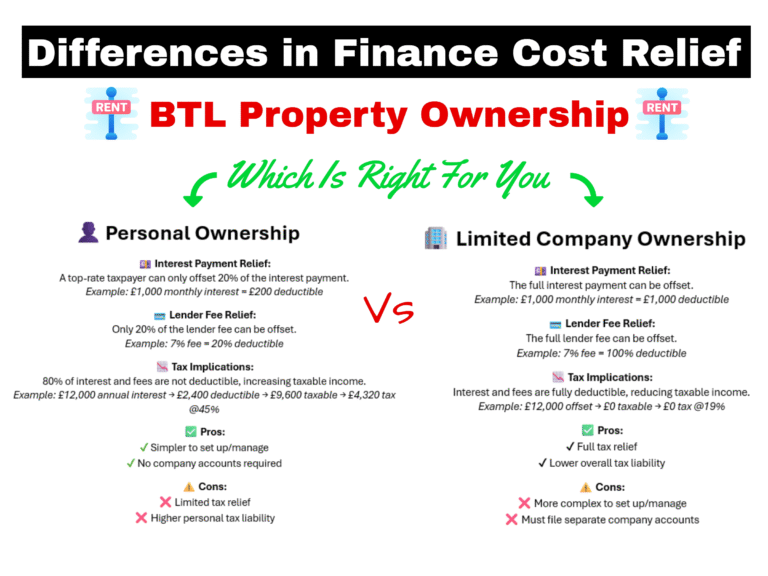

When it comes to Buy-to-Let (BTL) property ownership, how you structure your portfolio can have a major impact on the tax you pay. Since changes to mortgage interest relief rules, many landlords have found themselves facing higher tax bills when holding property in their own name. One alternative that has grown in popularity is owning BTL properties through a limited company.

Below, we compare the key differences in finance cost relief between personal ownership and limited company ownership, highlighting the tax implications, pros, and cons of each.